maine property tax calculator

The Property Tax Division is divided into two units. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Orange County Ca Property Tax Calculator Smartasset

The property tax credit established by the state of maine pursuant to 36 mrsa.

. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Excise tax is calculated by multiplying the MSRP by the mill rate as shown below. To use our Maine Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. For comparison the median home value in Hancock County is 20160000. The average rate in Maine is 109 18th in the country.

This means that the applicable sales tax rate is the same no matter where you are in Maine. Overview of Maine Taxes Maine has a progressive income tax system that features rates that range from 580 to. In many cases we can compute a more personalized property tax estimate based on your propertys actual assessment valuations.

YEAR 1 0240 mill rate YEAR 2 0175 mill rate YEAR 3 0135 mill rate YEAR 4 0100 mill rate YEAR 5. Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory. Property taxes are 351 of income in Maine 17th highest in the country.

Maine has a number of tax credits that benefit taxpayers in certain situations. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Maine has a 55 statewide sales tax rate and does not allow local governments to collect sales taxes.

Find My Tax Assessor. The state valuation is a basis for the allocation of money. Counties in Maine collect an average of 109 of a propertys assesed fair market value as property tax per year.

Municipal Services and the Unorganized Territory. This page provides information of interest to municipal assessors and other property tax officials in Maine. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in york county.

The Maine Property Tax Fairness Credit is available to low-income homeowners who paid property tax on a primary residence in the past year. For comparison the median home value in Cumberland County is 24840000. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

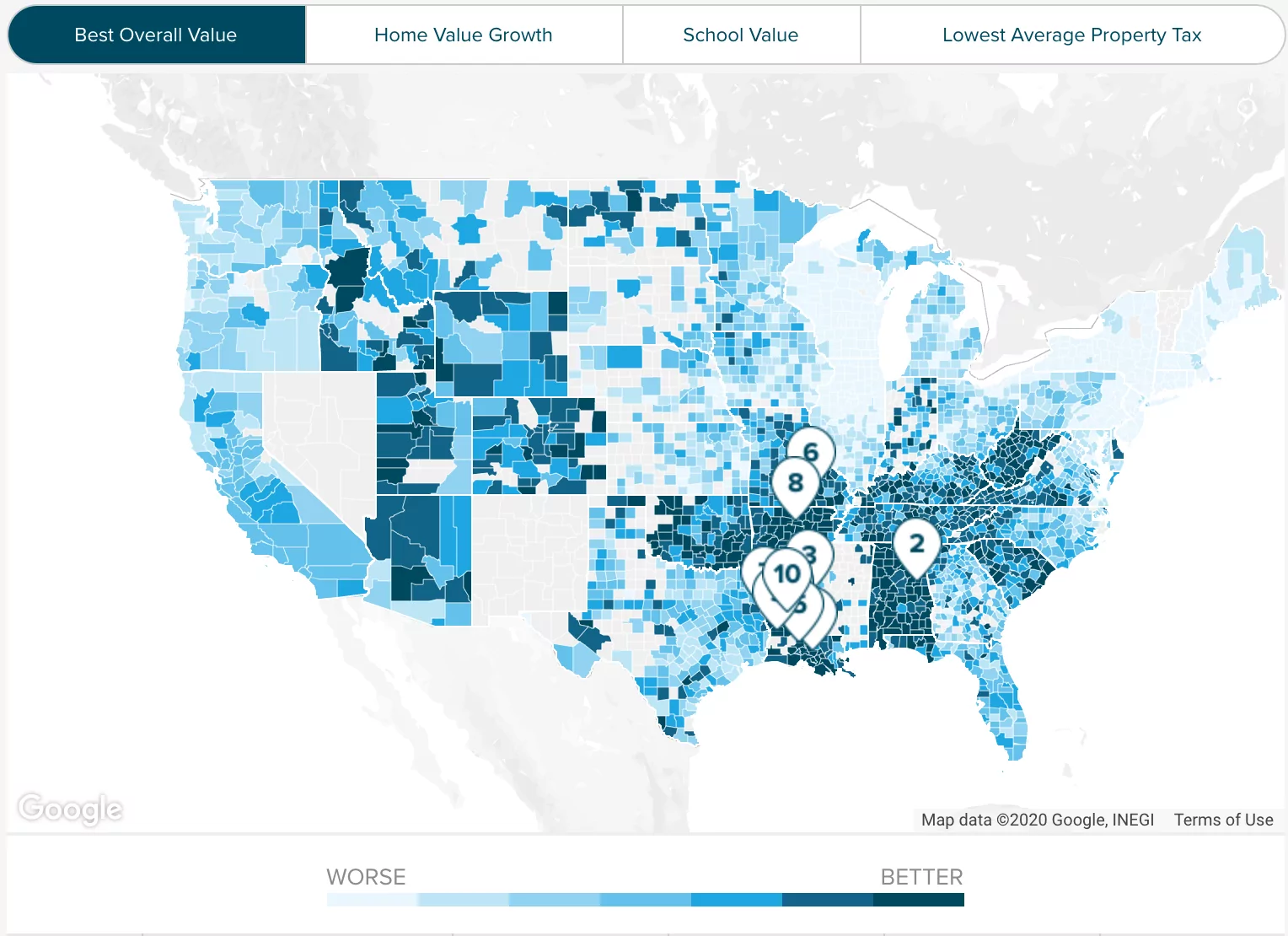

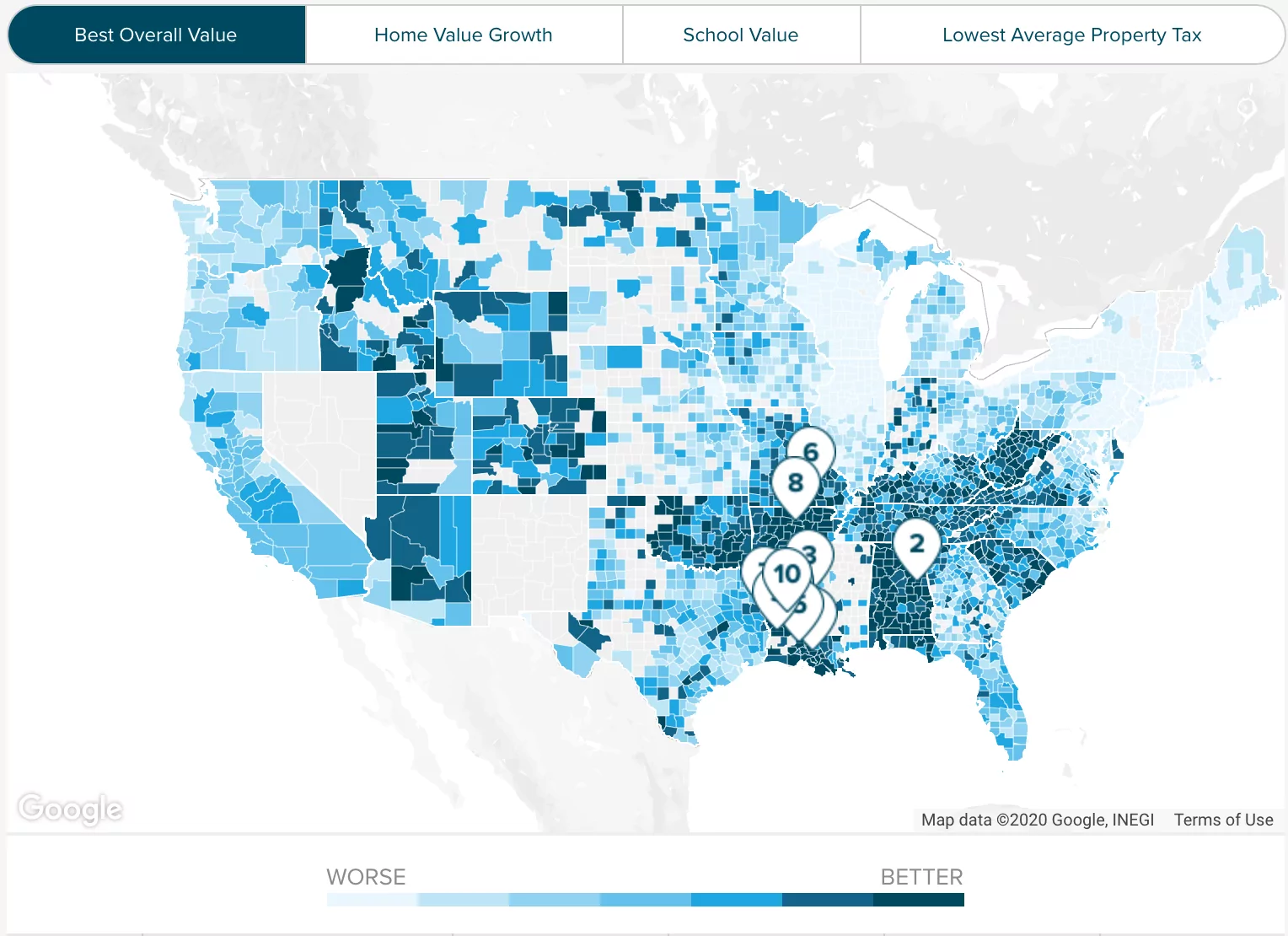

Maine Property Tax Calculator - SmartAsset Calculate how much youll pay in property taxes on your home given your location and assessed home value. The rates drop back on January 1st of each year. Generally property taxes are higher in the more southern and urban counties in Maine.

Property Tax By State. Your average tax rate is. Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory.

If there is something missing that you think should be added to this page feel free to email us with the link or suggestion. Maine Income Tax Calculator 2021 If you make 70000 a year living in the region of Maine USA you will be taxed 12188. Compare your rate to the Maine and US.

The median property tax in Maine is 193600 per year for a home worth the median value of 17750000. County Tax Assessors. The median income in Maine is 56277.

What Is Property Tax. Maine is ranked number twenty out of the fifty states in order of the average amount of property taxes collected. How is the excise tax calculated.

Find My Tax Assessor. The median property tax on a 15030000 house is 157815 in the United States. Property Tax By State.

Each spending category below corresponds to a Town budget category. Property tax fairness credit program. The Property Tax Division is divided into two units.

Property tax rates in maine are well above the us. The interactive calculator below allows property tax payers to enter the amount of their annual bill to learn how those dollars are allocated to various Town expenses. The median property tax on a 15030000 house is 163827 in Maine.

After a few seconds you will be provided with a full breakdown of the tax you are paying. The benefit for this credit for single filers is 750 depending on filing status and the number of exemptions claimed. The amounts shown are based on percentages derived from the approved FY19 Town of Hampden budget.

The state valuation is a basis for the allocation of money. Municipal Services and the Unorganized Territory. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Maine property tax records tool to get more accurate estimates for an individual property.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Waldo County. Our Maine Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Maine and across the entire United States.

2013 New Hampshire Tax Rates For Lakes Region Town Sorted By Town And By Rate New Hampshire Town Names Winnipesaukee

Property Taxes By State 2017 Eye On Housing

Thinking About Moving These States Have The Lowest Property Taxes

Ask Hannah Holmes What Is The Best Natural Way To Battle Weeds In 2021 Colonial Renovation Insulation Closed Cell Foam

How To Calculate Property Tax And How To Estimate Property Taxes

Property Taxes How Much Are They In Different States Across The Us

Walmart Lowe S Among Big Retailers Scheming To Avoid Maine Property Taxes Beacon Property Tax Walmart Tax

Deducting Property Taxes H R Block

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Property Taxes By State 2017 Eye On Housing

Here S What Could Change Your U S Property Tax Bill In 2022 And Beyond Stock Photography Estate Tax Stock Photography Free

Property Tax Appeal Tips To Reduce Your Property Tax Bill

623 Main Street Commercial Property Real Estate Tours

Did You Know In 2021 Property Tax Tax Reduction Tax Services

Property Tax By State Ranking The Lowest To Highest

Property Taxes By State 2017 Eye On Housing

What S Being Done To Reduce High Property Taxes In Illinois Property Tax Estate Tax Illinois

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)